Memorizing ReportsWhen you make modifications and customize a particular report, you may decide that you would like to save the settings and modifications, so that you can later pull the same report without having to go through all of the modifications. QuickBooks makes this easy with Memorized Reports.

Click on the

Modify Reports button and make whatever changes you would like to make. Complete your changes and click on

OK to return to the report.

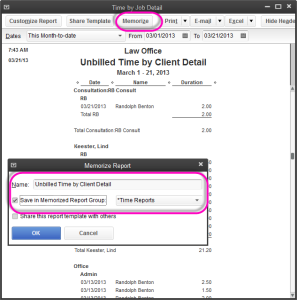

When you are done with report click on the

Memorize button in the top left hand part of the report window.

QuickBooks will now prompt you to enter a new name for the report. You can name it anything that you would like.

Click

OK to Finish.

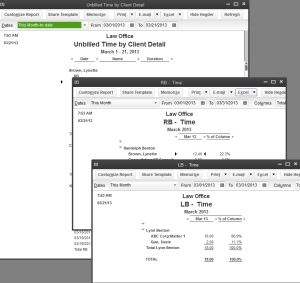

To retrieve the report at a later time, simply click on

Reports from the Main Menu, and then click on

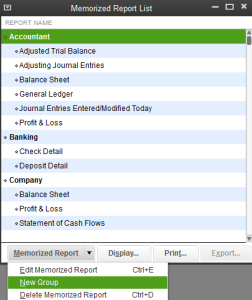

Memorized Reports. The report that you created will be on the list, and you can click on it to bring it up.

You can also create a Memorized Report group.

Click on

Reports from the Main Menu and click

Memorized Reports.

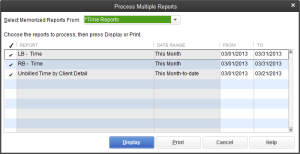

This will bring up a listing of the memorized reports.

Click the

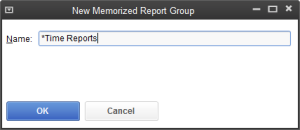

Memorized Report button at the bottom and choose

New Group.

Name your group. For example Trust Reports.

Click

OK when done.

Now click on a memorized report and click the

Memorized Report button at the bottom.

Click

Edit Memorized Report.

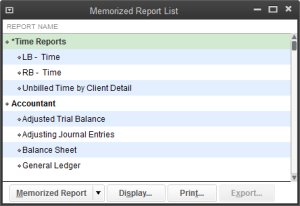

Add that report to your new group.

Now when it comes time to print out or display those reports you can just go to Memorized Reports, Choose the group and then Display or Print.