Here is an easy way to setup a payment plan in QuickBooks using the Invoice method.

You may have situations in which you want to setup a payment plan for a client using QuickBooks. Let’s say you are going to bill a client $2000.00 to do a case. One way you might want to do this is to create an invoice that day for the amount they are paying to start. Then create the remaining invoice or invoices individually with the date that they are due to make a payment. Use the terms as Due upon receipt. This will also allow you to create an aging report in the future so you can forecast what is coming in that month.

My new book for Law Practice Accounting using QuickBooks is available at www.attorneystechnology.com I show how to do this and so much more.

March 23, 2010

March 22, 2010

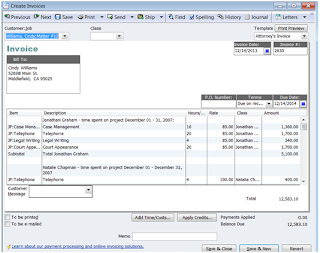

Creating an Invoice in QuickBooks Grouped by Timekeeper

You may want to create an invoice that has time activity grouped by item type or timekeeper. I will use the attorney sample file in QuickBooks to show you how to do this.

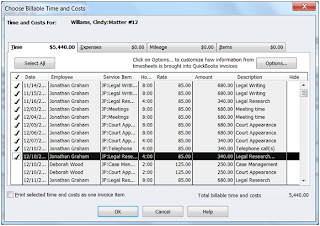

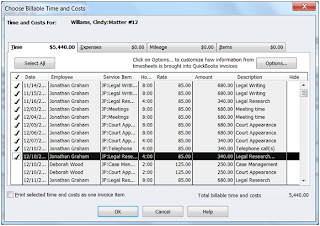

To do this, when you click on add time and cost to invoice you will first select the items you want to come into the invoice. For example we want to show Jonathan's time first.

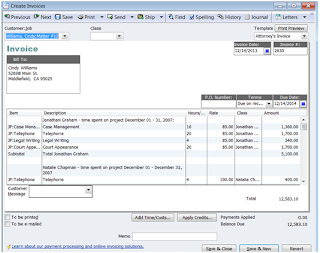

When the invoice comes up go to the bottom and add a line for the subtotal. This will add up all the lines above this group.

This is also great for grouping the expenses for things like postage and copies or other fees.

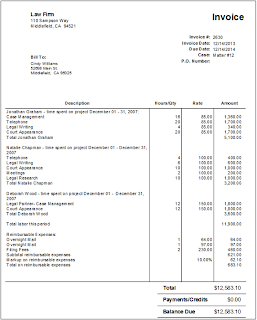

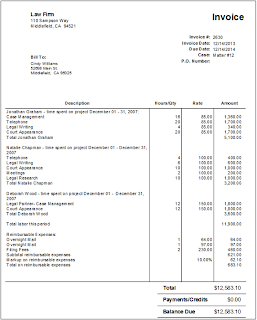

Here is what the invoice could look like.

You may want to get my new book Law Practice Accounting Using QuickBooks for 2010 and prior versions.

To do this, when you click on add time and cost to invoice you will first select the items you want to come into the invoice. For example we want to show Jonathan's time first.

When the invoice comes up go to the bottom and add a line for the subtotal. This will add up all the lines above this group.

This is also great for grouping the expenses for things like postage and copies or other fees.

Here is what the invoice could look like.

You may want to get my new book Law Practice Accounting Using QuickBooks for 2010 and prior versions.

March 16, 2010

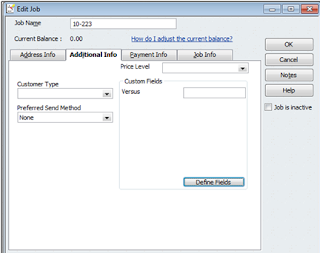

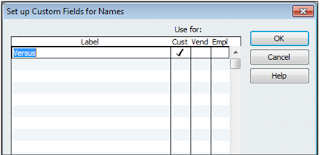

Checking for Conflicts of Interest with QuickBooks

QuickBooks has added a new find field in the customer list that can help you check your customer list for conflicts of interest. You can use the define fields to store other names that are associated with your clients. It is easy to use and attorneys may find it very helpful.

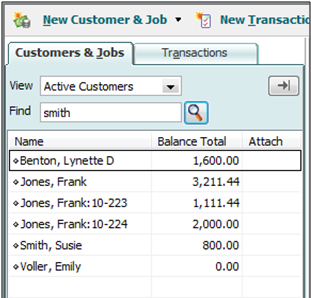

From the Home Page, choose Customers. QuickBooks displays the Customers: Jobs list.

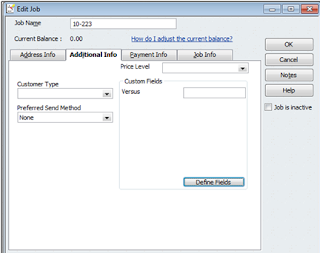

Click on the Customer Job that you would like to add a custom field to.

Click the Additional Info tab.

Click Define Fields.

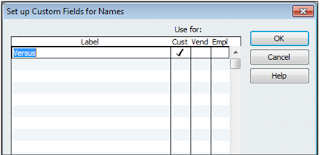

QuickBooks displays the Define Fields window.

In the first blank label field, type Versus.

Select the Customers: Jobs checkbox.

Click OK to close the Edit Customer window.

Close the Customers: Jobs list.

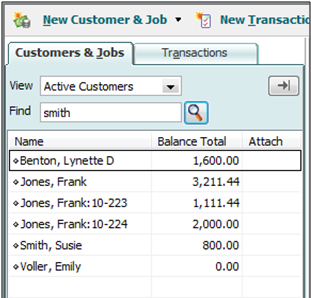

Finding names in the customer list

When you want to find a client or a name in your client list click on the find field on the customer list and then click the search box.

From the Home Page, choose Customers. QuickBooks displays the Customers: Jobs list.

Click on the Customer Job that you would like to add a custom field to.

Click the Additional Info tab.

Click Define Fields.

QuickBooks displays the Define Fields window.

In the first blank label field, type Versus.

Select the Customers: Jobs checkbox.

Click OK to close the Edit Customer window.

Close the Customers: Jobs list.

Finding names in the customer list

When you want to find a client or a name in your client list click on the find field on the customer list and then click the search box.

October 12, 2009

Save Time With Memorized Reports in QuickBooks

Memorizing ReportsWhen you make modifications and customize a particular report, you may decide that you would like to save the settings and modifications, so that you can later pull the same report without having to go through all of the modifications. QuickBooks makes this easy with Memorized Reports.

Click on the Modify Reports button and make whatever changes you would like to make. Complete your changes and click on OK to return to the report.

When you are done with report click on the Memorize button in the top left hand part of the report window.

QuickBooks will now prompt you to enter a new name for the report. You can name it anything that you would like.

Click OK to Finish.

To retrieve the report at a later time, simply click on Reports from the Main Menu, and then click on Memorized Reports. The report that you created will be on the list, and you can click on it to bring it up.

You can also create a Memorized Report group.

Click on Reports from the Main Menu and click Memorized Reports.

This will bring up a listing of the memorized reports.

Click the Memorized Report button at the bottom and choose New Group.

Name your group. For example Trust Reports.

Click OK when done.

Now click on a memorized report and click the Memorized Report button at the bottom.

Click Edit Memorized Report.

Add that report to your new group.

Now when it comes time to print out or display those reports you can just go to Memorized Reports, Choose the group and then Display or Print.

Click on the Modify Reports button and make whatever changes you would like to make. Complete your changes and click on OK to return to the report.

When you are done with report click on the Memorize button in the top left hand part of the report window.

QuickBooks will now prompt you to enter a new name for the report. You can name it anything that you would like.

Click OK to Finish.

To retrieve the report at a later time, simply click on Reports from the Main Menu, and then click on Memorized Reports. The report that you created will be on the list, and you can click on it to bring it up.

You can also create a Memorized Report group.

Click on Reports from the Main Menu and click Memorized Reports.

This will bring up a listing of the memorized reports.

Click the Memorized Report button at the bottom and choose New Group.

Name your group. For example Trust Reports.

Click OK when done.

Now click on a memorized report and click the Memorized Report button at the bottom.

Click Edit Memorized Report.

Add that report to your new group.

Now when it comes time to print out or display those reports you can just go to Memorized Reports, Choose the group and then Display or Print.

July 26, 2009

Moving Money from Trust to Operating in QuickBooks

The biggest mistake I see attorneys make while using QuickBooks for Trust Accounting is trying to get money from the Client Trust Account to the Law Firm Operating Account. If not done correctly, this can cause a major issue for your Client Trust Account Reports.

Don't make the mistake of just writing a check out of your trust account and code it to the operating account. Almost all of the trust account transactions should hit the client trust liability account and individual client's subaccount. By transferring or coding, you are skipping this step , and then you have no record of where that money is or who's money it came from.

Here is a quick breakdown of the proper steps for moving money for fees from your Client Trust Account to your Law Firm Operating Account.

1. Create a charge for your fees using statement charges or invoices.

2. Write a check out of the trust account and then choose the client's subaccount under the Client Trust Liability account.

3. Receive the payment against the charge just like you would if they walked in and paid you.

4. Make a deposit into your Operating account.

These steps will make sure that all of the transactions in the client trust liability account are balanced and will help you get the reports you need to stay in compliance with trust accounting rules and regulations.

If you are new to QuickBooks or would like more help with using QuickBooks in your Law Practice please take a look at my books; Law Practice Accounting Using QuickBooks and Maintaining a Trust Account Using QuickBooks you can also call me at 904-284-4480 and we can setup a consulting appointment to go over your needs. I specialize in this area of QuickBooks and offer training.

You can visit me at www.attorneystechnology.com

Don't make the mistake of just writing a check out of your trust account and code it to the operating account. Almost all of the trust account transactions should hit the client trust liability account and individual client's subaccount. By transferring or coding, you are skipping this step , and then you have no record of where that money is or who's money it came from.

Here is a quick breakdown of the proper steps for moving money for fees from your Client Trust Account to your Law Firm Operating Account.

1. Create a charge for your fees using statement charges or invoices.

2. Write a check out of the trust account and then choose the client's subaccount under the Client Trust Liability account.

3. Receive the payment against the charge just like you would if they walked in and paid you.

4. Make a deposit into your Operating account.

These steps will make sure that all of the transactions in the client trust liability account are balanced and will help you get the reports you need to stay in compliance with trust accounting rules and regulations.

If you are new to QuickBooks or would like more help with using QuickBooks in your Law Practice please take a look at my books; Law Practice Accounting Using QuickBooks and Maintaining a Trust Account Using QuickBooks you can also call me at 904-284-4480 and we can setup a consulting appointment to go over your needs. I specialize in this area of QuickBooks and offer training.

You can visit me at www.attorneystechnology.com

QuickBooks for Mac

How did I live without it? I recently purchased a Mac for the sole purpose of writing my book for attorneys and property owners who use QuickBooks on their Mac. I was surprised to see that it had a different look and feel than the PC version of QuickBooks. I was having so much fun with my Mac that I got rid of Verizon and purchased the IPhone.

Some of the differences that I noticed right off was how much faster QuickBooks runs on the Mac. The help files load fast and reports load faster. I love the fact that I can link my contacts to my address book and my IPhone!

I recommend attorneys use statement charges and not invoices. It is so hard or impossible to get notes out of the invoice for any reporting purposes. When using statement charges I entered a note with 250 characters and they all exported to excel. This is great! When I used the time sheet to enter information I noticed it will only let me put in 99 characters.

QuickBooks for Mac does not currently have a multi-user version. You can save your QuickBooks data file on your network, and different individuals in your organization can access the file, but not at the same time. Also, Windows and Mac versions of QuickBooks cannot work together on a multi-user license.

Well the book should be back from review this week. If you would like to be one of the first to get the book at a special price in August, please feel free to email me at lynette@attorneystechnology.com

Some of the differences that I noticed right off was how much faster QuickBooks runs on the Mac. The help files load fast and reports load faster. I love the fact that I can link my contacts to my address book and my IPhone!

I recommend attorneys use statement charges and not invoices. It is so hard or impossible to get notes out of the invoice for any reporting purposes. When using statement charges I entered a note with 250 characters and they all exported to excel. This is great! When I used the time sheet to enter information I noticed it will only let me put in 99 characters.

QuickBooks for Mac does not currently have a multi-user version. You can save your QuickBooks data file on your network, and different individuals in your organization can access the file, but not at the same time. Also, Windows and Mac versions of QuickBooks cannot work together on a multi-user license.

Well the book should be back from review this week. If you would like to be one of the first to get the book at a special price in August, please feel free to email me at lynette@attorneystechnology.com

May 6, 2009

Attorneys can Track Time, Retainers, Conflicts and More using QuickBooks

QuickBooks is the number one small business accounting software and for good reason. It is easy to use and reasonably priced. QuickBooks can do the following things that Attorneys generally need:

Track Billable and Non Billable Time - QuickBooks has a great Time Tracking feature. An attorney can track their billable and non billable time for their clients. It also has a Timer program that comes separate and able to run without QuickBooks. This enables everyone in the office to track time and the bookkeeper and pull the time into QuickBooks.

Billing Rates and Price Levels - You can create custom price levels for your clients. It can also track Billing Rate levels that can be associated by the time keeper. (This is available in the Professional Services edition.)

Conflicts of Interest – In the 2009 versions of QuickBooks you have the ability to do advanced searches quickly and easily within your customer list.

Retainers – Yes you can track retainers in QuickBooks. Reports can easily be created and memorized so you will always know what money you are holding in retainers.

Trust Accounting – Easily track the money you are holding in trust and create reports to help you stay in compliance with Trust Accounting Laws.

QuickBooks also has the ability to:

Write checks

Link to online Bank Accounts

Accounts Receivable

Accounts Payable

Payroll

1099’s

Need help getting started or training I can help. www.attorneystechnology.com

Track Billable and Non Billable Time - QuickBooks has a great Time Tracking feature. An attorney can track their billable and non billable time for their clients. It also has a Timer program that comes separate and able to run without QuickBooks. This enables everyone in the office to track time and the bookkeeper and pull the time into QuickBooks.

Billing Rates and Price Levels - You can create custom price levels for your clients. It can also track Billing Rate levels that can be associated by the time keeper. (This is available in the Professional Services edition.)

Conflicts of Interest – In the 2009 versions of QuickBooks you have the ability to do advanced searches quickly and easily within your customer list.

Retainers – Yes you can track retainers in QuickBooks. Reports can easily be created and memorized so you will always know what money you are holding in retainers.

Trust Accounting – Easily track the money you are holding in trust and create reports to help you stay in compliance with Trust Accounting Laws.

QuickBooks also has the ability to:

Write checks

Link to online Bank Accounts

Accounts Receivable

Accounts Payable

Payroll

1099’s

Need help getting started or training I can help. www.attorneystechnology.com

Subscribe to:

Posts (Atom)