Track time to bill clients

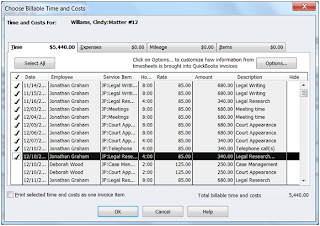

Track costs to bill clients

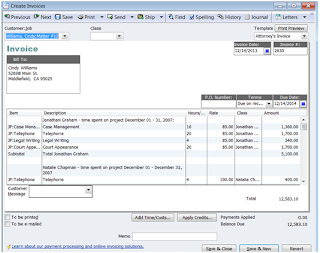

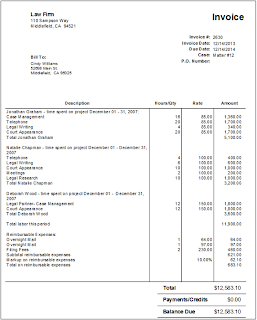

Bill clients for time and cost

Track income and expenses

Maintain a trust account

It is easy to accomplish if you have QuickBooks setup right to begin with. The biggest problem I have seen is neglecting the accounting aspect of your practice. Lets face it. You could be using any piece of software to handle your time and expenses but if you don't have an overall knowledge of how profitable your business is, you are just guessing.

Being able at any time to see how your practice is doing gives you a great piece of mind and a chance to fix things before it is to late. Most of the high price accounting packages for law firms are so complicated that you have to hire people that already know how to use them and then you are depending on them to tell you how it is going. With QuickBooks, you, the attorney, can easily learn how to get the information you want when you want it and you are not held hostage by a bookkeeper that may be the only one who knows how to run your software.

How long does it take to get setup and running? This is my most asked question. Here is a breakdown on the average time investment I think you will need to get up and running.

- 15 - 30 minutes phone call with you -Let me setup the file - I do this after I talk to you to find out a little about your practice and billing needs.

- 1 hour gathering information - This really depends on if you are starting out with a new practice or converting from another program. Things I would need to get your file setup would be client begin balances, client names and address information (I can show you how to add but if you have an existing program I can import this information for you) Trust account information, and billing rates.

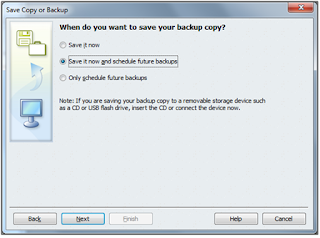

- 2 - 1 hour online consulting appointments - Using remote connection software, I will put the file on your computer and show you the basic functions of QuickBooks like how to setup clients and matters, how to enter your time, and how to bill for it, how to write checks for client costs and regular operating expenses and how to receive payments from clients.

- 1 hour online consulting for Trust Accounting. I will teach you how to handle your trust transactions and get the reports you need to be in compliance with your state bar association rules on trust accounts.

- 1 hour online consulting - This is usually after the first month. I show you how to reconcile and how to make sure your information is correct.

The total investment in time is usually 4 - 6 hours and you will know how to use your accounting software to get the information that you need to make sure that your practice is healthy, and in compliance. I have been teaching attorneys how to do this for over 15 years and it works. You are welcome to contact me if you have any questions.